Imaginary Blockscape

by Felix Linsmeier

Besides sea shanties, NFTs were probably the most hyped internet trend of 2021. Evangelists proclaimed that the technology would fuel nothing less than “an artistic revolution.” This past summer, reports about millions upon millions being spent on digital artworks flooded news channels. By the end of the year, every major institution from FC Bayern to UNICEF seemed to have hopped aboard the glittering train. Today, the technology may have yielded more ideological problems than actual artistic potential, but for experimental music, this maybe shouldn’t matter that much.

By internet standards, NFTs are old news. The first NFTs were already created in 2012 when some of today’s crypto millionaires were probably still speculating for the Pokémon card bull market in their schoolyard. Success stories like CryptoPunks or CryptoKitties launched in 2017. The following year, the ZKM Center for Art and Media Karlsruhe dedicated an exhibition to NFTs. In 2019, the total value of circulating tokens already amounted to roughly 210 million dollars. Yet, the real explosion of interest came last year when the digital artist Beeple auctioned the NFT for his collage Everydays: The First 5000 Days at Christie’s. The amalgamation of cartoons (including a whiff of racism and misogyny) sold for a nice 69 million dollars. It is now the third most expensive work by a living artist of all time.1

Decentral Park in the Dark

A non-fungible token is an encrypted certificate which identifies the owner of a digital object. You’re not buying the painting but – effectively – paying to have your name engraved on the tiny sign next to it. Many of the works associated with NFTs are hardly exclusive. A famous example is the first-ever tweet, by Twitter founder Jack Dorsey, which sold for 2.9 million dollars. In fact, the accessibility and copy-and-paste reproducibility of these digital objects could be an attention-granting part of the appeal.

Often, “smart contracts” are linked with the tokens, which regulate additional agreements such as division of streaming proceeds and royalties for every resell. Generally, the purchaser has no rights to the files associated with the artwork itself, though they often receive exclusive tidbits such as sheet music, concert tickets, or additional digital content. This means that although every NFT is unique, having an NFT does not make you the only person who can look at the painting or listen to the piece of music you bought.

The authenticity of the ownership token is certified on the blockchain, a network of decentralized computers which offer their processing power to produce ever-expanding databases. Blockchains are most widely known as the architectural structure of cryptocurrencies (such as Bitcoin) where decentrality is the key aspect that gets widely proclaimed as a magic cure in revolutionizing a global economy where “normal” currencies, certificates, and (art-)markets are attached to centralized executive bodies like states, confederations, regulating authorities, or auctioneers. In this way, blockchains, and the crypto market in general, serves – ideologically – as an anarcho-capitalist counter-, or at least sideline, reality. NFTs also use the same blockchain technology as cryptocurrencies, and their communities have in common a deep distrust of centralized institutions, be they regulatory or curatorial, and an apocalyptic bent.

The Web of the early days can be nostalgically glorified as a decentralized socialization of digital data (to the chagrin of many copyright holders) and Web 2.0 as a centralized private economy occupied by giant corporations such as Google, Amazon, and Meta, with sluggish multilateral regulation. Web 3.0 is now supposed to be the user-based, decentralized salvation and, with all its market-radical crypto-structures, can provide both freedom and security in the collapse of the existing monetary systems. The latter might sound like prepper-speak, but it is a narrative that one encounters frighteningly often on crypto sites and Reddit threads. In regards to the actual independence of the crypto market, of course, most people only invest in order to sell lucratively again, whereby the market is determined by extreme fluctuations and risks. The fact that the participation of stinking auction houses like Christie’s and Sotheby’s in the NFT market or El Salvador’s acceptance of bitcoin as a currency for development represent such milestones for their communities shows their ingratiation and dependency on the market in general. But is decentralization really that practical? The crypto world is full of fraudsters, and when NFTs worth millions are stolen (yes, it happens), logically there can be no complaint body or crypto police. Only the code and the owners listed there are the law. In libertarian space, no one can hear you scream.

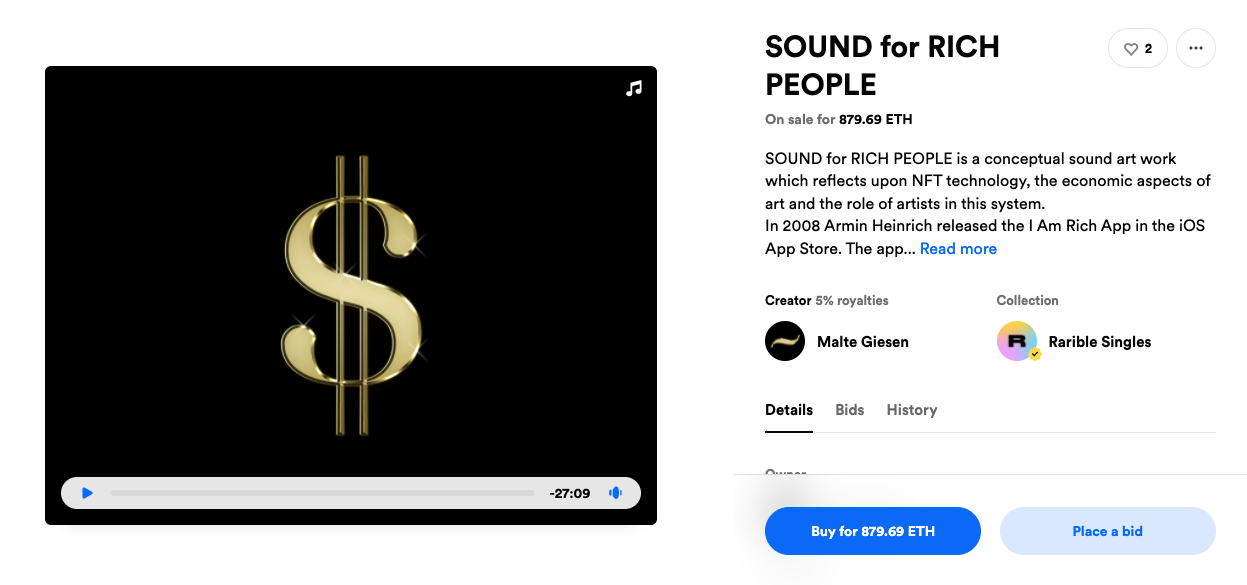

SOUND for RICH PEOPLE

In December 2021, composer Malte Giesen presented his first NFT, SOUND for RICH PEOPLE, as an homage to the $999.99 iPhone app I Am Rich from 2008. The NFT is linked to a twenty-seven-minute recording of white noise: “The white noise is a metaphor for wealth, as it contains all possible frequencies, therefore containing every possible sound in the universe – it is the universal starting and end point of sound. It is in every aspect a rich sound and in this work: a sound for the rich?” The piece is listed for 879.69 ETH (€3,127.68). No one has purchased Giesen’s work.

In December 2021, composer Malte Giesen presented his first NFT, SOUND for RICH PEOPLE, as an homage to the $999.99 iPhone app I Am Rich from 2008. The NFT is linked to a twenty-seven-minute recording of white noise: “The white noise is a metaphor for wealth, as it contains all possible frequencies, therefore containing every possible sound in the universe – it is the universal starting and end point of sound. It is in every aspect a rich sound and in this work: a sound for the rich?” The piece is listed for 879.69 ETH (€3,127.68). No one has purchased Giesen’s work.

What are we experimenting on, again?

In the Cageian sense, an “experimental action is one the outcome of which is not foreseen.”2 To understand the potential of NFTs for experimental music, we don’t need to look any further than this sixty-year-old one-liner.

Kolja Reichert noted in his 2021 book Krypto Kunst: Digitale Bildkulturen (Crypto-Art: Digital Image Cultures), “NFTs accompany a categorical change in what we perceive as cultural assets. They don’t refer to physical objects in space, but to moments in time instead.”3 He further pronounced the “work” itself only as an indirect object of trade, the sold file being its cover (like a CD cover). He writes, “NFTs reduce the understanding of art to its economical part: unique historical opportunities, created by artificial shortage. It’s the spectacular grab of this opportunity that’s being purchased, the act of purchasing itself. The bought commodity serves as its evidence.”4

Presenting music, not just the typical experimental type, can always be understood as an experiment with a limited foreseeable outcome. Audience reactions, from success to dislike and – in the worst case – apathy, are always some kind of black box. Following this understanding of crypto art, this risk of public reception is a threat to the fundamental existence of a work. A piece of music that is minted as an NFT but – as most NFTs do – remains unbought, is left behind as an empty shell, a relic of a faded “unique opportunity,” an insubstantial cover.

The question of value is even more difficult to pursue in immaterial art than in the conventional art market. Traditionally, only the market transforms the use value of a work of art – which lies in the object of aesthetic experience – into the substrate of its exchange value. Buying and selling are not only promising investments and playgrounds of speculation but also generate symbolic capital for the owner and the artist. So far, it is also the case with crypto: the most successful NFT projects, like Bored Ape Yacht Club, create algorithmically generated, collectable images for buyers to display as profile pictures – and voilà! – the search for a digital transposition of material status symbols is complete. Where an Insta shot of a sports car or “Sent from my iPhone” have a tacky concreteness to them, a JPEG of a cartoon monkey apparently displays a more ethereal wealth and a value system that embraces the cutting edge and the decentralized.

Here, the NFT business is even more dependent on the cruel laws of the attention economy than the traditional art market. Consequences were limited when an early draft of Mozart’s The Marriage of Figaro failed to sell at auction in 2018,5 but the performance of NFTs is like a bubble that needs constant artificial inflating to be kept alive. Ownership is speculative. The earning potential is in the selling and reselling, which maintains and multiplies the absurdly high prices. This also explains the cultish mannerisms of crypto disciples: without constant growth the bubble threatens to implode, and because previous owners are often included in potential future deals, this can resemble a typical pyramid scheme. Those who get in early, or have lots to invest, earn their profit from the people who join the market later. Of course, it takes some honest-to-god stories of rapid rises or obscene profits to keep the flame of neoliberal hope flickering inside the average Elon-Musk-fanboy’s heart. The NFT market is essentially a game of hot potato: ditch it before the music stops or you’ve not only lost the match but also a tidy sum.

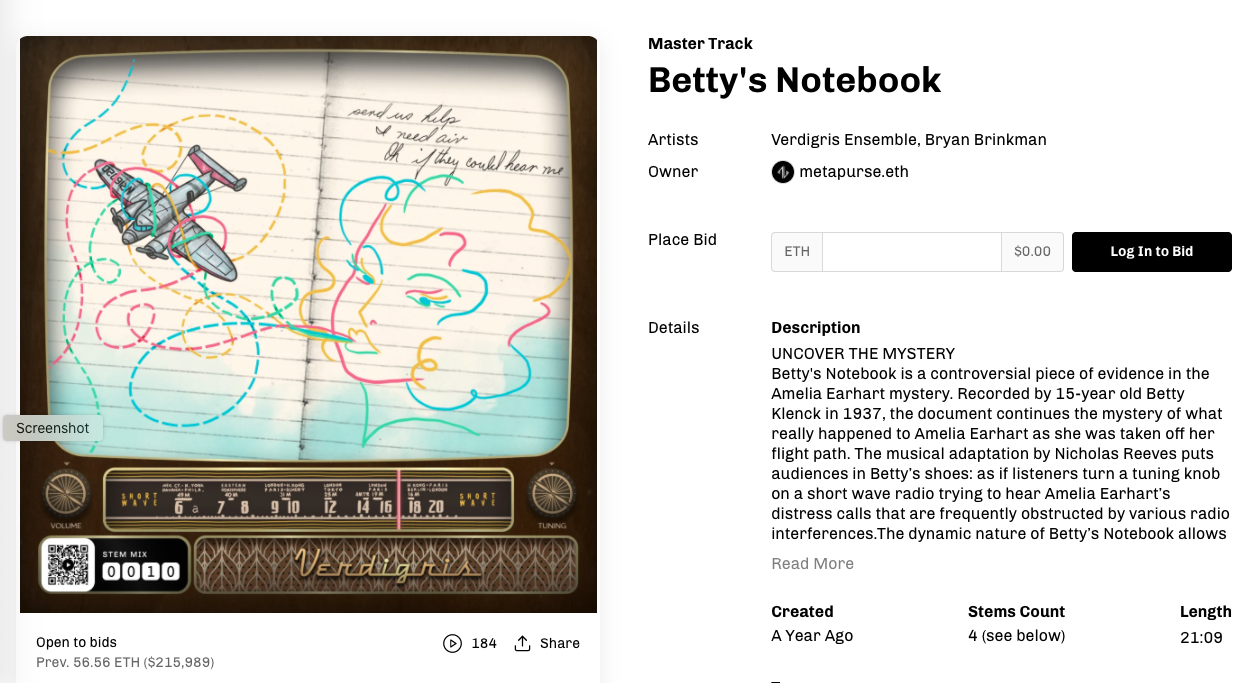

Betty’s Notebook

The twenty-one-minute “programmable piece of music” Betty’s Notebook by vocal ensemble Verdigris is divided into several individual pieces sold as NFTs. The piece is based on the notes of fifteen-year-old Betty Klenck who allegedly received and noted down a distress signal from the missing Amelia Earhart on a shortwave radio in 1937. The piece consists of four stems, groups of superimposed tracks: 1. The Choir, the sixteen-piece ensemble singing Earhart’s words; 2. Betty’s Voice, a sample of a later interview with Klenck; 3. Betty’s Radio, jazz songs in the style of the time; and 4. Betty’s Choir, a musical setting of the interview, based on the pitches of a spectral analysis. There are three different versions of each of the stems, differing in texture, timbre, and programmatic narrative. Buyers of an NFT decide the composition of each version from the forty-eight possible combinations. This is then written down on the blockchain. A “real” converted wooden radio from the 1930s, as well as the digital museum async.art, play the current mix as an adaptive master track. The master track was acquired by the same investor as Beeple’s Everydays: The First 5000 Days.

The ensemble’s musical director Sam Brukhman draws promising conclusions from the sale in an hour-long talk (also featuring Kim Noltemy, the president of the Dallas Symphony Orchestra): “The buyer had no experience or knowledge of classical music, but he saw the value in it. Where musicians before depended on how many people would buy an album, today we can sell one-offs and originals, as well as copies, like fine artists.” Betty’s Notebook sold for more than $375,000 in total.

Program Music

Before embracing NFTs wholeheartedly, classical music would do well to understand the crypto scene’s hostility toward institutions. Musical institutions, at least in Europe, rely heavily on state subsidies, which the NFT world’s libertarian leanings demonize. Furthermore, the aesthetic of NFTs are also shaped by completely different standards of value judgments. The peppery charm of the little effort that the algorithm-generated Bored Apes or CryptoPunks exude has become one of the prevailing visual standards for images. Dmitri Kourliandski’s work for Process and Protocol, From the Letters of Happiness, resembles this artificial aesthetic while it reflects dealing with the “nonexistent.” At first glance, it almost seems that the crypto aesthetic runs counter to the fashions of the outside world, but the idea that the culture industry of capitalism immediately and successfully appropriates every attempt at the subversive for its own benefit is not a particularly new one, either.

There’s a reason why so much reporting about NFT art – including this piece – focuses on its monetary implications rather than the actual works. The counterculture of NFTs was not annexed by the culture industry, but rather tailored to its body from the beginning – which is also evident in Sam Brukham’s statements. The noble goal of opening up new and young audiences and convincing them of the importance of the classical music sector naturally does not serve the purpose of enabling educational processes or the progressive evolution of art, but rather the enhancement of a sometimes more, sometimes less artificial construct of “value.” And this happens, if the radical market demands it, at any price, however devastating.

The most important market for NFTs runs on the Ethereum blockchain, which also hosts the cryptocurrency Ether (ETH). The network relies on a “proof-of-work” algorithm, whereby individual computers guarantee the validity of the newly minted tokens through massive computing power. (Users are paid for their energy contributions.) This computing power expended by the decentralized network has a climate impact that is hard to overstate. The carbon footprint of a single average NFT is estimated at 211 kilograms, which translates to a round-trip flight from Berlin to Warsaw. Every additional sale, auction, and change of ownership raises this value significantly. As a whole, the blockchain Ethereum consumes more electricity per year than the Philippines or Belgium. A single Ether transaction is equivalent to the electricity consumption of a German in two months. So, if you’re an artist today, you have the chance to make a clear, immediate, and lasting impact on the world with art like never before. Revolutionary!

In early 2020, Ethereum announced a plan to make its blockchain 98 percent more climate-friendly this year, but that’s already looking unlikely to happen.6 Alternative blockchains and currencies like Cardano and Solana are comparatively climate-friendly and offer their own NFT marketplaces. However, neither have nearly the scale of Ethereum.

Crowdsourcing Benefits

The NFT hype of the last year is an illustration of the sad state of affairs facing musicians, developments which the pandemic has only sped up. Album sales are an expense for the artist rather than a source of income; streaming services pay artists fractions of a cent while allowing consumers to listen guilt-free. Concerts, the last reliable anchor of the musicians’ income, won’t be on solid footing anytime soon. With all this in mind, you can’t condemn artists pouncing on a promising-sounding system. This new desire for immaterial possessions, and a willingness to spend good money on them, may even be a positive trend if it leads to more fertile connections between artists and audiences. The question is whether NFTs are really the right medium to encourage these connections. The project Betty’s Notebook is a positive example of the potential of NFTs – not because it has sold well, but because it uses the concept of the tokens as a constitutive element of the piece. The simple sale of recordings can, of course, work if there is demand, but as long as the works can be separated from the formal framework, they are threatened with loss of meaning and interchangeability.

NFT-based user networks called DAOs (decentralized autonomous organizations) provide a grassroots democratic infrastructure making financial as well as creative decisions for associated projects. Last summer, Berlin-based composer and musician Holly Herndon hit the headlines when she provided Holly+, a singing deepfake clone of herself, for creative use and laid the rights to her voice and thereby her whole musical persona into a DAO’s hands. For Process and Protocol, Loré Lixenberg will crowdsource the audience’s creativity, tokenizing the visitor’s vocal performances, thereby commodifying and financializing them.

When I first got to write an essay about NFTs in classical music earlier this year, my main point of criticism was that the technical medium usually does not provide any real added artistic value to the associated works. Crypto prophets market NFTs with what they claim are original selling strategies: tickets coupled with album sales, blockchain-based crowdfunding, or private sponsorships à la Patreon. But, minus the technology, none of these are new ideas,7 and it’s not clear how moving them to the blockchain adds to their appeal. It’s something NFTs have in common with many other supposedly futuristic projects – such as Elon Musk’s Loop, which boils down to a very inefficient subway. Most of the proclaimed potential of NFTs is no more than a transposition of established models of funding and patronage to a complicated, decentralized technology, with all its problems and ecological or ideological dangers. This revolution is not (yet) of the arts but of the art market – and the change is happening less in the market’s composition (artificial valuation, auctioneering, speculation, and even money laundering is still here to stay) than in the radical conditions of a libertarian ideology that were hardly conceivable in previous trading areas.

Looking back, the potential we must look for works the other way around. It’s not what a technological medium, a worldwide occurrence, or an economical system can offer the works of artists, but what artists can contribute to help set the course in a rather new medial and social phenomenon. As Kolja Reichert puts it, “Art allows fundamental self-reflection of systems and thus guarantees their ability to innovate”8 – a useful tool to shape an action the outcome of which is not foreseen.

Felix Linsmeier works as a composer and orchestrator for concert or theatrical settings and as an author for VAN Magazine and neue musikzeitung. A versatile trombonist at heart, he is the current recipient of an artists’ grant by the state of Bavaria for arranging music by women and BIPOC composers for brass ensembles.

Beyond Follows

by Sarah Friend

Crypto Art Annotations

By Geert Lovink